The tax industry

needs to change.

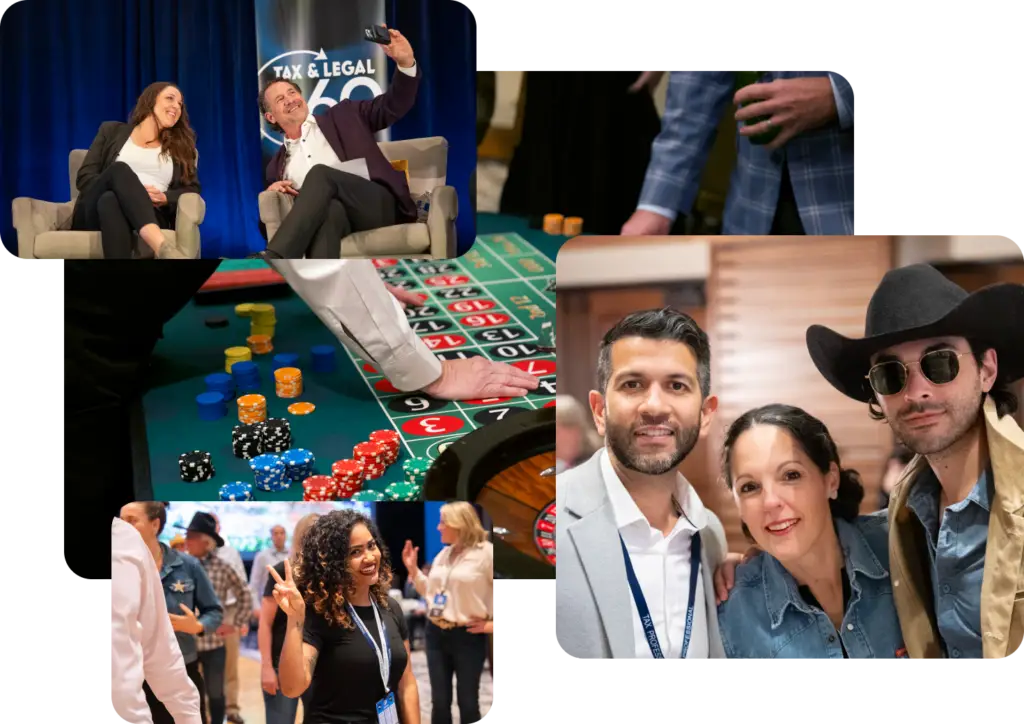

You've never been to a

Tax & Legal conference

like this before.

Led by the renowned leader, speaker and influencer, Mark J. Kohler, Tax & Legal 360 is a powerhouse gathering where professionals converge to get an in-depth, panoramic view of the tax sphere’s most impactful topics… and have a blast doing it! This is where knowledge is gained, relationships are forged, and change is possible.

It's time to bring life back to taxes.

We’re going to show you how.

20+ Speakers

30+ Topics

40+ Sessions

Casino night

Carnival Party

Previous Topics

Everything Roth IRAs: The Equation for Tax-Free Wealth

Building Strong Client Relationships in Your Advisory Practice

Advanced Self-Directing Strategies & the IRA/LLC

Captive Insurance: When to Consider and When to Run

Buying or Selling a Business: Tax and Legal Considerations

1031 Exchanges: Basics and Current Trends

Using 501(c)3s and Non-Profits to Leave a Legacy

Short Term Rentals: Tax Consequences & Opportunities

… and many more!

Salt Lake City, UT

June 5-8

Grand America Hotel

Everything kicks off June 5th at 6 PM with a Welcome Reception, followed by food & fun mixed in between sessions for three straight days. Find your seat and come join your tribe!

Imagine loving tax season.

By investing in new skills, new connections, and a new outlook, your career can be everything you want it to be. But don’t take our word for it.

Tickets now available!

What you get:

3 Days of Cutting-Edge Tax Strategies

30+ Topics & 40+ Sessions

3-Month Access to recordings of All Sessions

Welcome Reception

6-month Access to Recordings of All Sessions

Daily Lunch in Networking Room

Carnival Party

Casino Night

Front Row Priority Seating

What you get:

3 Days of Cutting-Edge Tax Strategies

30+ Topics & 40+ Sessions

3-Month Access to Recordings of All Sessions

Welcome Reception

6-month Access to Recordings of All Sessions

Daily Lunch in Networking Room

Carnival Party

Virtual

$399

$399

3 Days of Cutting-Edge Tax Strategies

30+ Topics • 40+ Sessions

Access for 3 Months to the Recordings for ALL Sessions

General

$499

$499

3 Days of Cutting-Edge Tax Strategies

30+ Topics • 40+ Sessions

Access for 3 Months to the Recordings for ALL Sessions

Welcome Reception

Premium

Classroom Seating

$999

$999

3 Days of Cutting-Edge Tax Strategies

30+ Topics • 40+ Sessions

Welcome Reception

Access for 6 Months to the Recordings for ALL Sessions

Lunch Included Daily in Networking room

VIP

VIP Seating

$2,495

3 Days of Cutting-Edge Tax Strategies

30+ Topics • 40+ Sessions

Welcome Reception

Access for 6 Months to the Recordings for ALL Sessions

Lunch Included Daily in Networking room

Breakfast Saturday morning with Mark and Special Guest

Can't be there in person?

No problem! Purchase your virtual ticket for just $399 and get a front row seat to all the fun from anywhere in the world.

- Live Chat Q&A hosted by Tax Attorneys

- 3 Days of Cutting-Edge Tax Strategies

- 3-Month Access to Recordings of All Sesssions

- 30+ Topics | 40+ Sessions

Sponsors